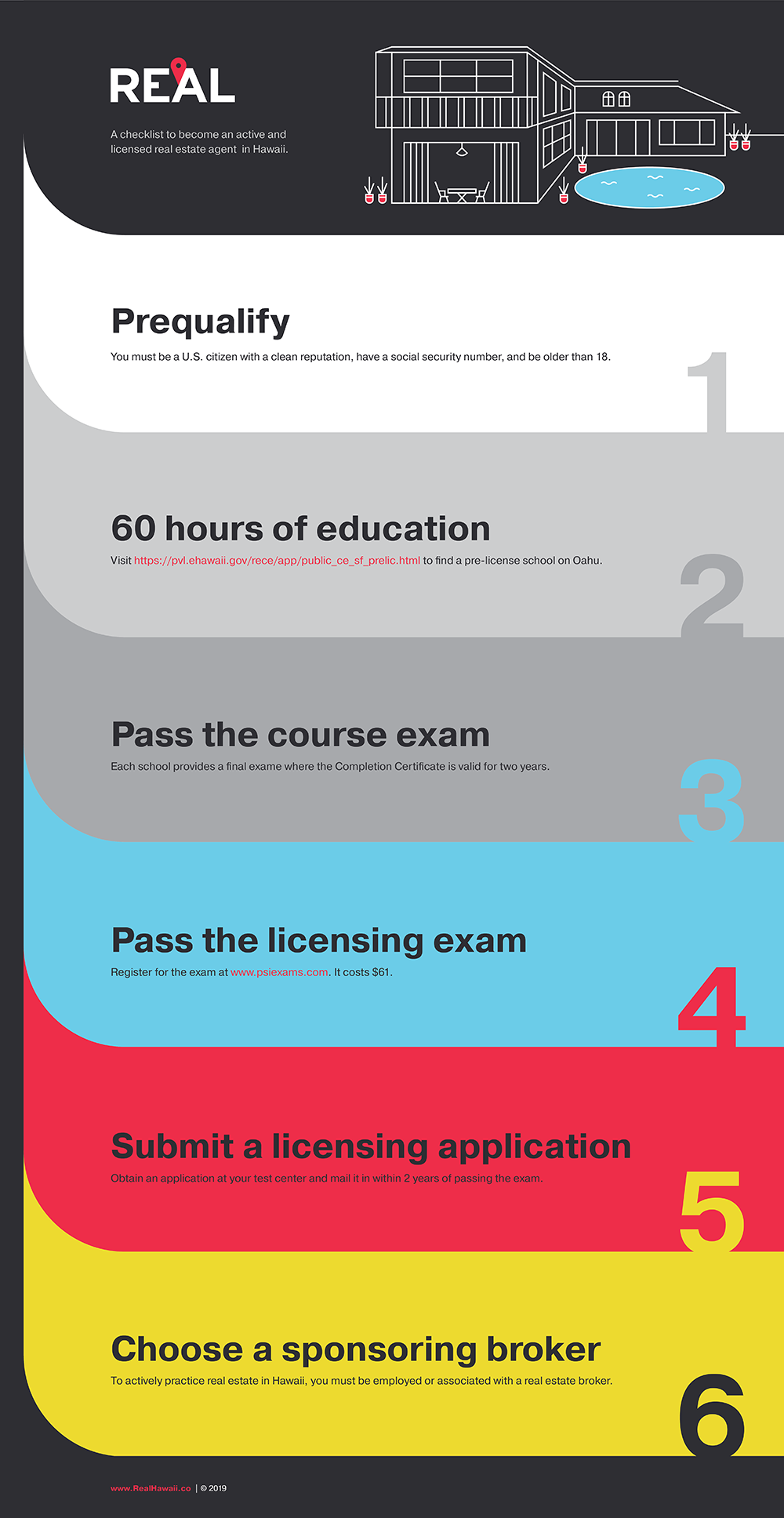

It is easy to obtain a license as a Oklahoma real estate agent if you follow the rules. You will need to be at the least 18 years in order to get started. You will also need a high-school diploma, proof of U.S. Citizenship, and a criminal background. The pre-licensing education requirement includes 90 hours, as well as proof of completion. The final step is passing the exam.

The Oklahoma real estate exam must be completed in no more than 3 hours to pass. You will be asked 120 multiple choice questions. There are also 40 state-specific and 80 national questions. To earn a passing score, you must answer at least 60 questions correctly.

You don't have to be a Oklahoman resident to take the exam at PSI locations all across the United States. For the exam, you'll need to pay $60. It is non-refundable.

The next step in getting your Oklahoma real estate license is to submit an application. Your fingerprints will be required. You can submit them via IdentoGo or another licensed vendor. The background check involves taking your fingerprints along with other documentation. Processing of the background check may take up to 60 business days.

To obtain a license as a broker, you must have at least two years' experience in the same field. You'll also need to take 90 clock hours of advanced real estate instruction, and demonstrate a good moral character. After reviewing your application, the commission will inform you if you have been approved. The $100 licensing fee will be due.

The background check is the next part of the process. You will receive notification via email once you have submitted your application. If you've been found to have a criminal record, you'll need to submit a criminal history report or other evidence. If necessary, the commission will review your file and inform you.

Background checks are required when you apply for your real-estate license. Your fingerprints will be used. This may also include your criminal records. Your background report will include a variety of information, such as judgments, criminal histories, and more. On the Oklahoma Real Estate Commission’s website, you can find additional information about the background check.

Once you've passed your background check, you can take the Oklahoma real estate exam. The exam is computer-based and contains 80 questions specific to Oklahoma and 40 questions national. This exam is closed-note. To take the exam, you will need a basic calculator as well as a passport-type photograph. OREC can be contacted if you're unable to take your exam within five working days of you applying.

You will need to retake the Oklahoma real estate exam if you are unable to pass it within ten days. You have two options: enroll in a class in person or online. The course will include legal descriptions, home ownership laws, fair housing legislation, appraisals, real estate finance, and more. Also, the course will cover real estate transaction laws as well the ethics of being an agent.

FAQ

How can I find out if my house sells for a fair price?

It could be that your home has been priced incorrectly if you ask for a low asking price. If your asking price is significantly below the market value, there might not be enough interest. For more information on current market conditions, download our Home Value Report.

How long does it take to sell my home?

It all depends on several factors such as the condition of your house, the number and availability of comparable homes for sale in your area, the demand for your type of home, local housing market conditions, and so forth. It can take from 7 days up to 90 days depending on these variables.

What's the time frame to get a loan approved?

It depends on several factors including credit score, income and type of loan. It typically takes 30 days for a mortgage to be approved.

What is the cost of replacing windows?

Replacement windows can cost anywhere from $1,500 to $3,000. The cost of replacing all your windows will vary depending upon the size, style and manufacturer of windows.

What are the three most important factors when buying a house?

The three most important factors when buying any type of home are location, price, and size. The location refers to the place you would like to live. The price refers to the amount you are willing to pay for the property. Size refers to how much space you need.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How do I find an apartment?

When you move to a city, finding an apartment is the first thing that you should do. Planning and research are necessary for this process. It involves research and planning, as well as researching neighborhoods and reading reviews. While there are many options, some methods are easier than others. Before renting an apartment, it is important to consider the following.

-

Data can be collected offline or online for research into neighborhoods. Online resources include Yelp and Zillow as well as Trulia and Realtor.com. Local newspapers, real estate agents and landlords are all offline sources.

-

You can read reviews about the neighborhood you'd like to live. Yelp and TripAdvisor review houses. Amazon and Amazon also have detailed reviews. You can also find local newspapers and visit your local library.

-

Call the local residents to find out more about the area. Talk to those who have lived there. Ask them what they loved and disliked about the area. Ask for recommendations of good places to stay.

-

You should consider the rent costs in the area you are interested. Consider renting somewhere that is less expensive if food is your main concern. If you are looking to spend a lot on entertainment, then consider moving to a more expensive area.

-

Find out more information about the apartment building you want to live in. It's size, for example. How much does it cost? Is it pet-friendly? What amenities are there? Do you need parking, or can you park nearby? Are there any rules for tenants?