The first step in buying a house is to determine how much money you can save. It will require a down payment and closing costs. Additionally, you need to budget for ongoing maintenance and repairs. This calculator will give you an idea of how much you need to save for your down payment, mortgage, and other homebuying expenses.

How Much Can I Afford

You can only spend as much on a house as you have money. This depends on your income and how much debt you have. In order to qualify for a loan mortgage, your housing costs must not exceed 28%.

A down payment? Save your money

In most cases, you'll need at least a 5-10% down payment on a home to avoid paying private mortgage insurance (PMI), which is often a requirement of many loans. The amount of down you will need depends on how good your credit is and what type of loan you have.

How to save money for a downpayment

You can start saving for your down payment by creating a budget. This will allow you to see what you can and cannot afford each month as well as where you can cut costs. Now it's time for you to start saving.

These are just a few steps that will help you quickly reach your savings goals. You must first pay off all debts and establish an emergency fund covering 3-6 month living expenses. This will protect you from any unexpected circumstances.

You can make small withdrawals from your paycheck or set up automatic deposits to a savings account when you are ready to save. After you have saved a significant amount, you can start looking for a house.

How to Use Your Downpayment Funds

Many lenders require that your down payments be made from your own funds. This can include funds you've accumulated from saving, selling an asset or earning a raise at work. You have two options: you can buy a home that is less expensive or you can wait until you are able to save more.

How to find a cheaper mortgage

By comparing mortgage rates, you can cut down on your home-buying cost. There are many lenders that offer adjustable-rate and fixed-rate mortgages. Some lenders will let you borrow a portion from the purchase price as an initial payment.

The most common loans available to home buyers are FHA, VA and conventional loans. Each loan has its benefits and requirements, but they all have one thing in common: It can be difficult to get a loan without large down payments.

It's not impossible to buy a house with a small down payment, but it will require you to be patient and save more than you might otherwise be able to. You can start by reducing your other expenses and slowly chipping away at your down payment.

FAQ

What is the average time it takes to sell my house?

It depends on many factors, such as the state of your home, how many similar homes are being sold, how much demand there is for your particular area, local housing market conditions and more. It may take up to 7 days, 90 days or more depending upon these factors.

How can I determine if my home is worth it?

You may have an asking price too low because your home was not priced correctly. A home that is priced well below its market value may not attract enough buyers. To learn more about current market conditions, you can download our free Home Value Report.

What is a reverse loan?

A reverse mortgage is a way to borrow money from your home without having to put any equity into the property. It works by allowing you to draw down funds from your home equity while still living there. There are two types of reverse mortgages: the government-insured FHA and the conventional. A conventional reverse mortgage requires that you repay the entire amount borrowed, plus an origination fee. FHA insurance will cover the repayment.

How do I get rid termites & other pests from my home?

Your home will be destroyed by termites and other pests over time. They can cause serious destruction to wooden structures like decks and furniture. It is important to have your home inspected by a professional pest control firm to prevent this.

How long does it take for a mortgage to be approved?

It depends on many factors like credit score, income, type of loan, etc. It usually takes between 30 and 60 days to get approved for a mortgage.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

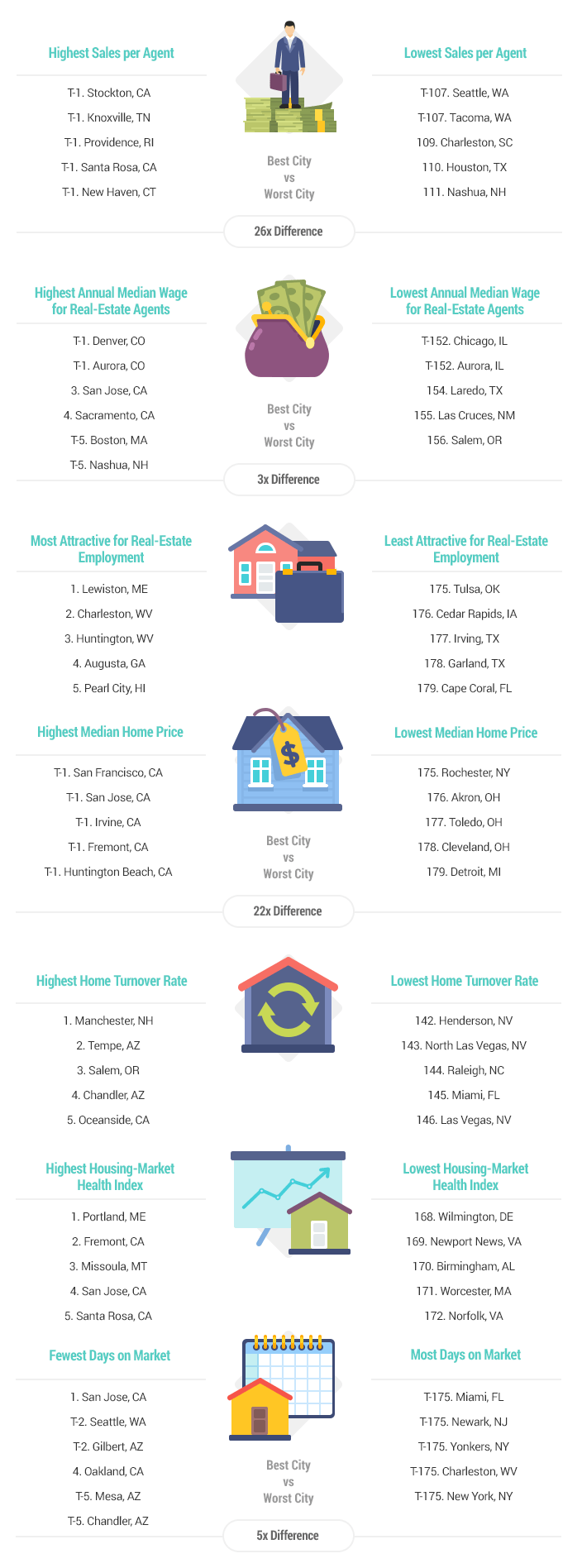

How to find real estate agents

The real estate market is dominated by agents. They sell homes and properties, provide property management services, and offer legal advice. You will find the best real estate agents with experience, knowledge and communication skills. Online reviews are a great way to find qualified professionals. You can also ask family and friends for recommendations. You may also want to consider hiring a local realtor who specializes in your specific needs.

Realtors work with homeowners and property sellers. A realtor helps clients to buy or sell their homes. As well as helping clients find the perfect home, realtors can also negotiate contracts, manage inspections and coordinate closing costs. Most realtors charge commission fees based on property sale price. Unless the transaction closes, however, some realtors charge no fee.

The National Association of REALTORS(r) (NAR) offers several different types of realtors. NAR membership is open to licensed realtors who pass a written test and pay fees. A course must be completed and a test taken to become certified realtors. Accredited realtors are professionals who meet certain standards set by NAR.