It is possible to start building a wealth and a lifestyle by buying real estate young. You have the advantage of being able to invest with a smaller down payment, a better credit score, and a greater risk tolerance. You'll be more open to trying new types of property, and learning new skills than older investors.

While investing in real property has many benefits, it's important that you are making the right decisions. While it may seem tempting to choose an asset that offers a high return, remember that only so much can be done with that asset. You should also keep your expenses low. This means that you pay your mortgage on-time and avoid taking out excessive debt. These problems can be avoided by consulting a professional to help you make the right decisions.

A good first step is to learn as much as you can about investing in real estate. You can find tons of information on the Internet or by talking to a real estate agent. Websites and government agencies can provide additional information about the local economy.

A solid credit rating will allow you to get a mortgage. It will also prevent you being denied for loans. In order to keep a high credit score, ensure that you regularly pay your bills. A home equity loan can also be offered for a lower monthly interest rate.

In addition to a good credit score, you should have some money in savings. It is important to have enough money saved for your down payment. Some cases may qualify you for the Federal Housing Administration's downpayment assistance program. You can even apply for programs that are designed to help multifamily units.

The most important thing is to know how to accurately assess the value of real estate investments. The repair value of the house is one way to do this. Calculating the repair value requires some math and the purchase price of the home. This will give you a clear picture of how much you'll need to fix the house and how much you can sell it for.

Another useful measure of a successful real estate investment is the ROI. The ROI measures the return on investment compared to the amount invested in a property. It is important to consider the metrics associated with this metric such as the gross rental multiplier, the loan/to-value ratio and the internal return rate.

The down payment is often the biggest hurdle that young people face when purchasing a home. There are many down payment assistance programs that can help you purchase a house for less than 20%. You can also look into real estate funds for quick returns.

FAQ

What are the chances of me getting a second mortgage.

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is usually used to consolidate existing debts and to finance home improvements.

How much does it cost to replace windows?

Windows replacement can be as expensive as $1,500-$3,000 each. The total cost of replacing all your windows is dependent on the type, size, and brand of windows that you choose.

What are the benefits of a fixed-rate mortgage?

Fixed-rate mortgages allow you to lock in the interest rate throughout the loan's term. This guarantees that your interest rate will not rise. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

External Links

How To

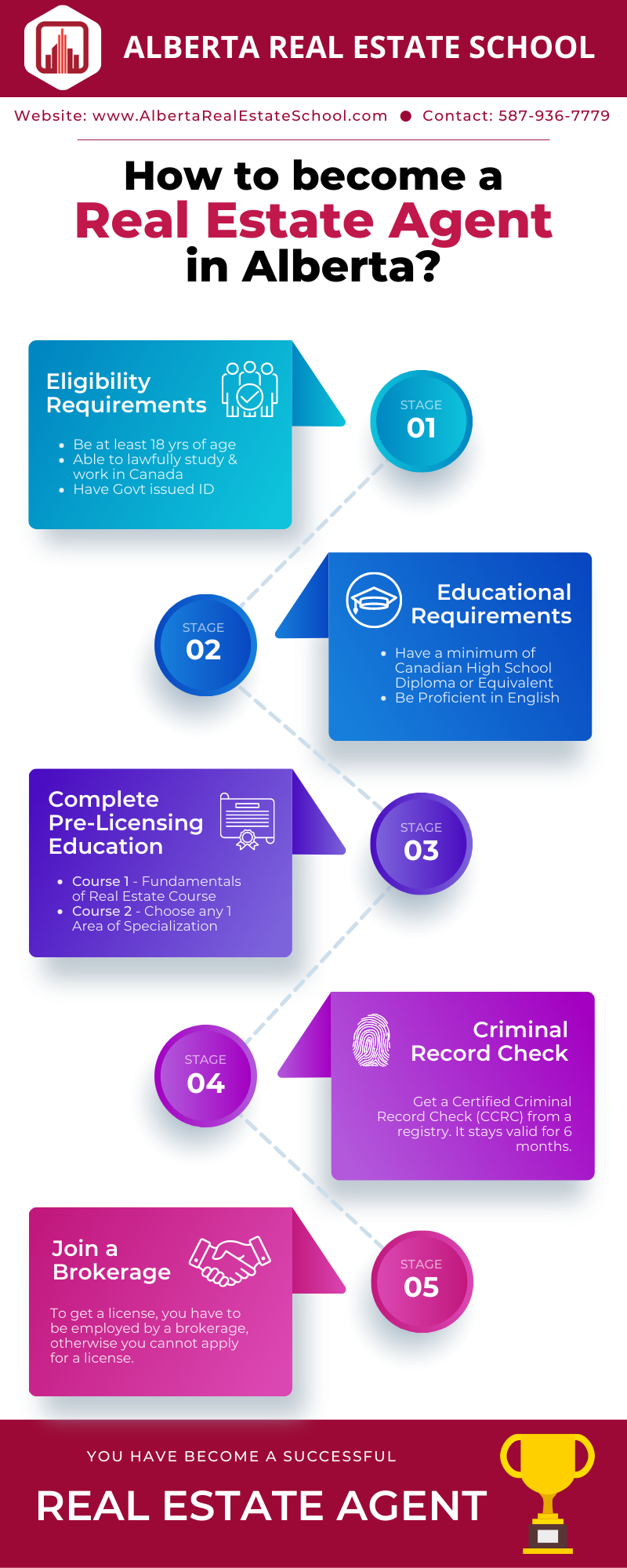

How to become a real estate broker

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This requires you to study for at least two hours per day for a period of three months.

Once this is complete, you are ready to take the final exam. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

Once you have passed these tests, you are qualified to become a real estate agent.