A variety of tax write-offs are available to real estate agents. These deductions will help you lower your taxes and save money each tax year. However, it is important to be aware of these tax deductions as some of them can be complex and you should consult with a professional accountant if you are not sure what you can deduct from your taxes.

Are you a Real Estate Agent?

A real estate agent, a self-employed individual who makes a profit with their business, is considered self-employed. This profit can be claimed on Schedule C of the real estate agent's personal income tax return. This form attaches to the IRS Form 10040. It calculates a real agent's personal and self-employment taxes.

Home Offices Are a Great Tax Deduction for Real Estate Agents

A tax deduction can be claimed if your business has its own workspace. This deduction is subject to several conditions. For example, the space must be entirely dedicated to your business. It must be used for business purposes only, and not as a place to sleep.

Cell Phones Are Another Tax Deduction for Real Estate Agents

You can also claim a percentage of your monthly cell phone bill as a deduction if you make business calls from that number. This can help you cut down on business expenses. It will also allow you to track the calls you make to work.

Business Equipment

The full cost of any equipment that you purchase for your company can be claimed as a tax deduction. This includes all equipment that you use in the course of your business. There are some exceptions to this rule, however. If you use the equipment less than 50% of your business's time, the equipment may not be fully deductable.

Commissions are Another Tax Deduction for Real Estate Agents

Commissions you pay to agents or employees working for you can be deducted from your tax. These expenses can quickly add to your tax bill and can make it more affordable.

Business legal fees

Real estate agents must pay legal fees to open a business or prepare documentation for their license. These fees are tax-deductible and can be added to any real estate license renewals or MLS fees you pay.

Marketing and Advertising

Advertising expenses such as brochures, signage, and photography can all be deducted. As a real-estate agent, you can also claim for any business-related training and seminars.

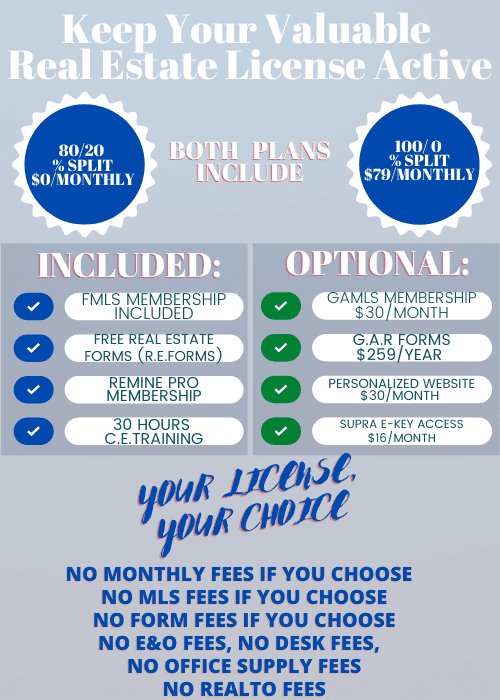

Desk fees are a tax deduction that real estate agents can use to deduct from their taxes

Most brokers charge their agents an agent a desk fee. This will vary depending upon the brokerage and where it is located. They could be flat fees or monthly fees that cover your costs for office space, tools and training.

FAQ

Can I get a second loan?

Yes. But it's wise to talk to a professional before making a decision about whether or not you want one. A second mortgage is used to consolidate or fund home improvements.

How can I calculate my interest rate

Market conditions affect the rate of interest. The average interest rates for the last week were 4.39%. Multiply the length of the loan by the interest rate to calculate the interest rate. If you finance $200,000 for 20 years at 5% annually, your interest rate would be 0.05 x 20 1.1%. This equals ten basis point.

What are the most important aspects of buying a house?

Location, price and size are the three most important aspects to consider when purchasing any type of home. Location is the location you choose to live. The price refers to the amount you are willing to pay for the property. Size refers the area you need.

How can I eliminate termites & other insects?

Your home will be destroyed by termites and other pests over time. They can cause damage to wooden structures such as furniture and decks. To prevent this from happening, make sure to hire a professional pest control company to inspect your home regularly.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

How to Find Real Estate Agents

The real estate market is dominated by agents. They help people find homes, manage their properties and provide legal advice. You will find the best real estate agents with experience, knowledge and communication skills. You can look online for reviews and ask your friends and family to recommend qualified professionals. It may also make sense to hire a local realtor that specializes in your particular needs.

Realtors work with homeowners and property sellers. A realtor's job it to help clients purchase or sell their homes. In addition to helping clients find the perfect house, realtors also assist with negotiating contracts, managing inspections, and coordinating closing costs. Most realtors charge commission fees based on property sale price. However, some realtors don't charge a fee unless the transaction closes.

The National Association of Realtors(r), (NAR), has several types of licensed realtors. To become a member of NAR, licensed realtors must pass a test. The course must be passed and the exam must be passed by certified realtors. NAR has set standards for professionals who are accredited as realtors.