No matter if you are new to the industry or have been in it for some time, there are many ways you can increase your chances of succeeding. Open houses are a great way to meet other agents and learn about the market. To find the right home for you, search MLS data.

You may be interested in a part-time position if you are planning to work full-time in real estate. This will allow you to build a network of people. This will enable you to work on your business while also earning an income. Although part-time work is not something you would do during the day, it can provide you with a steady income for up to six months.

If you are interested in working with a real estate company, you will be able access to clients and receive coaching. Be prepared to make slow sales when you're starting out. Keep your costs low until you have a business.

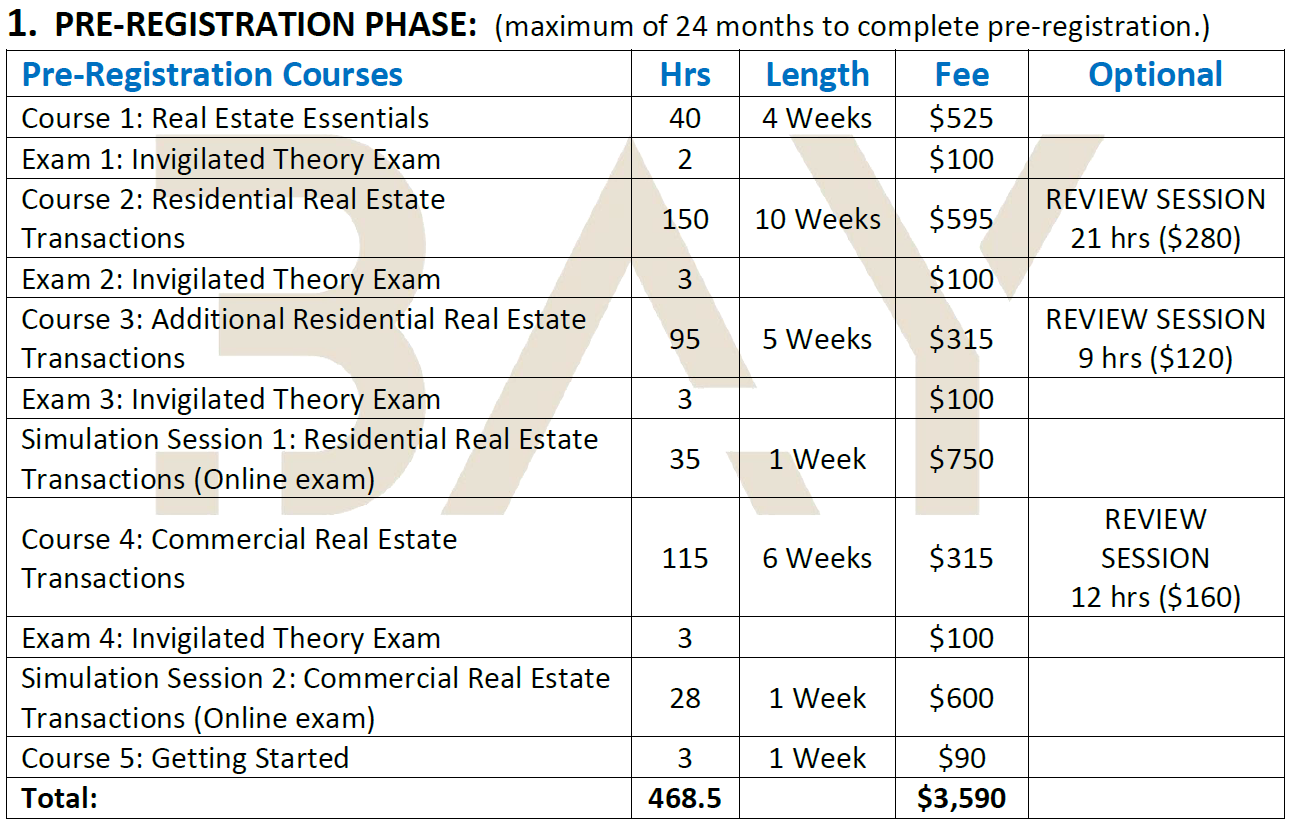

To help you succeed, you can also invest in training programs. You will need to consider your skills and find a program that offers several classes. It may be a good idea to get some pre-licensing training if you are just starting out in the business. This will give a good overview of the industry, and help you understand how to approach it.

You should also find a mentor or coach who can provide you with guidance and advice. Having a person to turn to will help you deal with the difficult transition into the real estate business. You can also look online for expert content platforms that can help you learn about the real estate market.

You will need a license depending on where you live and what state you are in. Exam fees, lock boxes, business cards, and other costs will be required. This can add up to a few thousand dollars in the first year.

A website is a must for your real-estate business. While most companies will provide a website, you can also promote your services on social media. You will need to create some materials and then publish them online. You can also reach out to market professionals in your area for information.

To be successful, you must have a strong sense of purpose. This means you must not compare yourself with others. Instead, focus on your own growth and improvement. If you do this, you will thrive in any market.

You must be able to read contracts. You will also need to be able to communicate with brokers and other real-estate professionals. A positive outlook and good social skills are essential. This is especially important for those who will be working with a lot.

FAQ

How much money do I need to save before buying a home?

It depends on the length of your stay. It is important to start saving as soon as you can if you intend to stay there for more than five years. But if you are planning to move after just two years, then you don't have to worry too much about it.

What is the average time it takes to get a mortgage approval?

It depends on many factors like credit score, income, type of loan, etc. It usually takes between 30 and 60 days to get approved for a mortgage.

Should I rent or own a condo?

Renting could be a good choice if you intend to rent your condo for a shorter period. Renting lets you save on maintenance fees as well as other monthly fees. A condo purchase gives you full ownership of the unit. The space is yours to use as you please.

How do you calculate your interest rate?

Market conditions affect the rate of interest. The average interest rates for the last week were 4.39%. Divide the length of your loan by the interest rates to calculate your interest rate. For example, if $200,000 is borrowed over 20 years at 5%/year, the interest rate will be 0.05x20 1%. That's ten basis points.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

How to manage a rental property

You can rent out your home to make extra cash, but you need to be careful. We'll show you what to consider when deciding whether to rent your home and give you tips on managing a rental property.

If you're considering renting out your home, here's everything you need to know to start.

-

What should I consider first? Before you decide if your house should be rented out, you need to examine your finances. If you have debts, such as credit card bills or mortgage payments, you may not be able to afford to pay someone else to live in your home while you're away. Check your budget. If your monthly expenses are not covered by your rent, utilities and insurance, it is a sign that you need to reevaluate your finances. It might not be worth the effort.

-

What is the cost of renting my house? Many factors go into calculating the amount you could charge for letting your home. These include factors such as location, size, condition, and season. It's important to remember that prices vary depending on where you live, so don't expect to get the same rate everywhere. Rightmove reports that the average monthly market price to rent a one-bedroom flat is around PS1,400. This means that your home would be worth around PS2,800 per annum if it was rented out completely. Although this is quite a high income, you can probably make a lot more if you rent out a smaller portion of your home.

-

Is it worth it? There are always risks when you do something new. However, it can bring in additional income. Be sure to fully understand what you are signing before you sign anything. It's not enough to be able to spend more time with your loved ones. You'll need to manage maintenance costs, repair and clean up the house. Make sure you've thought through these issues carefully before signing up!

-

Are there benefits? You now know the costs of renting out your house and feel confident in its value. Now, think about the benefits. Renting out your home can be used for many reasons. You could pay off your debts, save money for the future, take a vacation, or just enjoy a break from everyday life. It's more fun than working every day, regardless of what you choose. Renting could be a full-time career if you plan properly.

-

How do you find tenants? Once you decide that you want to rent out your property, it is important to properly market it. Listing your property online through websites like Rightmove or Zoopla is a good place to start. Once you receive contact from potential tenants, it's time to set up an interview. This will help to assess their suitability for your home and confirm that they are financially stable.

-

How can I make sure that I'm protected? If you're worried about leaving your home empty, you'll need to ensure you're fully protected against damage, theft, or fire. In order to protect your home, you will need to either insure it through your landlord or directly with an insured. Your landlord may require that you add them to your additional insured. This will cover any damage to your home while you are not there. If you are not registered with UK insurers or if your landlord lives abroad, however, this does not apply. In these cases, you'll need an international insurer to register.

-

Sometimes it can feel as though you don’t have the money to spend all day looking at tenants, especially if there are no other jobs. Your property should be advertised with professionalism. Make sure you have a professional looking website. Also, make sure to post your ads online. Also, you will need to complete an application form and provide references. Some people prefer to do everything themselves while others hire agents who will take care of all the details. In either case, be prepared to answer any questions that may arise during interviews.

-

What should I do once I've found my tenant? You will need to notify your tenant about any changes you make, such as changing moving dates, if you have a lease. If this is not possible, you may negotiate the length of your stay, deposit, as well as other details. You should remember that although you may be paid after the tenancy ends, you still need money for utilities.

-

How do you collect the rent? When the time comes for you to collect the rent you need to make sure that your tenant has been paying their rent. If not, you'll need to remind them of their obligations. Any outstanding rents can be deducted from future rents, before you send them a final bill. If you're having difficulty getting hold of your tenant you can always call police. The police won't ordinarily evict unless there's been breach of contract. If necessary, they may issue a warrant.

-

What are the best ways to avoid problems? It can be very lucrative to rent out your home, but it is important to protect yourself. Install smoke alarms, carbon monoxide detectors, and security cameras. Make sure your neighbors have given you permission to leave your property unlocked overnight and that you have enough insurance. Do not let strangers in your home, even though they may be moving in next to you.